Fall/Winter 2020

Fall/Winter 2020 Edition

COMMON CENT$ AND INFORMATION

Chesterfield Residents,

Many of my past messages have addressed the City’s revenues and finances. Not to disappoint, this article will focus on the realization that our City has become too reliant on sales tax revenues as a primary source of paying for the cost of services we provide. We rely on sales tax for more than half of the City’s total revenues. Those revenues are subject to wide fluctuations and we are losing substantial revenues from on-line sales which are an increasing proportion of total sales.

Although from time to time, this has been discussed over the years, the financial shortfalls we are experiencing due to COVID have brought to light the need to put before the voters a very small property tax that would diversify and stabilize our revenues.

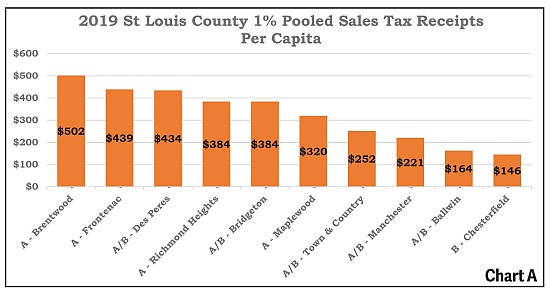

Chesterfield is not alone in the fact that an overwhelming majority of revenues come from sales taxes (this is true for most municipalities), and contrary to popular belief, there are many municipalities that have a much higher sales tax generation per resident than does Chesterfield. This puts us at a competitive disadvantage with many other cities in being able to provide quality services with the revenues generated per resident. (see Chart A)

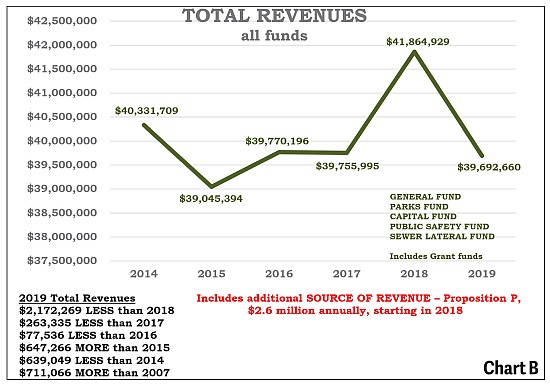

This situation is exacerbated by the fact that we have no property tax that comes to the City of Chesterfield, whereas many other municipalities do have substantial property taxes. The simplest way of analyzing this predicament is to look at the annual revenues of our City over the last several years. As you can see from looking at the chart below, our total revenues have declined (even before COVID), and even with the substantial influx of prop P revenues (well in excess of $2 million/year), the trend is dramatically downward. (see Chart B)

For many years (with the exception of a short period) the City of Chesterfield has prided itself by not having any property tax coming to our coffers. However, in reviewing the other 88 municipalities within St. Louis County, we find that approximately 76 of these municipalities have a property tax authorized on either or both residential and commercial property. The average amount of the total mill levy is 53 cents per one hundred dollars of assessed value. Just to review how the property tax works, it begins with an appraised value which is multiplied by 19% for residential properties and 32% for commercial properties to give an assessed value. For every 100 dollars of assessed value multiplied by the total mill levy gives the property tax on individual properties.

Although the mill levies are slightly higher in Rockwood, the Parkway School District rate is currently about $7.00 per 100 dollars of assessed value. Whereas our council has not decided if or how much of a property tax to put on a ballot, I would suggest a very small amount in the neighborhood of 10 cents for residential property, and a higher amount of 20 cents for commercial properties. As you can see, these amounts (if approved) are considerably lower than the 53 cents average of those cities that currently have this source of revenue, and would be a nominal increase relative to the total levy of $7.00 per hundred dollars of assessed value. I.E., for every $100,000 dollars of appraised value, the tax increase would be about $19. ($95 for a home valued at $500,000). This is not a pleasant or comfortable topic to bring up because all of us want to keep our taxes as low as possible, but given the realities and factors involved to ignore our circumstances would not be responsible. Please don’t hesitate to ask for additional information on this topic. This information is intended to be educational.

Stay safe, respectfully,

Mayor Bob Nation